aurora co sales tax license

Annual - Taxes due of 100 or less per year Reporting. Sale Tax License information registration support.

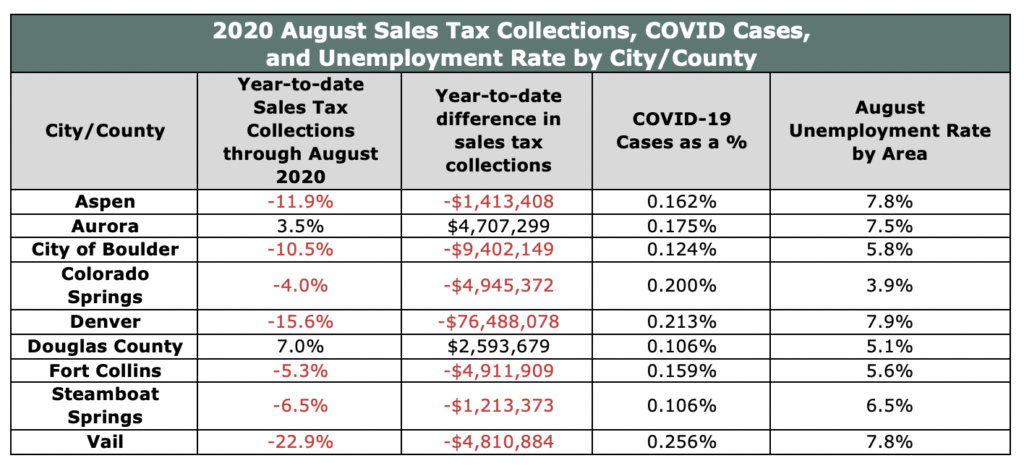

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

LicenseSuite by Business Licenses LLC provides you with everything you need to obtain an Aurora Colorado Sales Tax Permit.

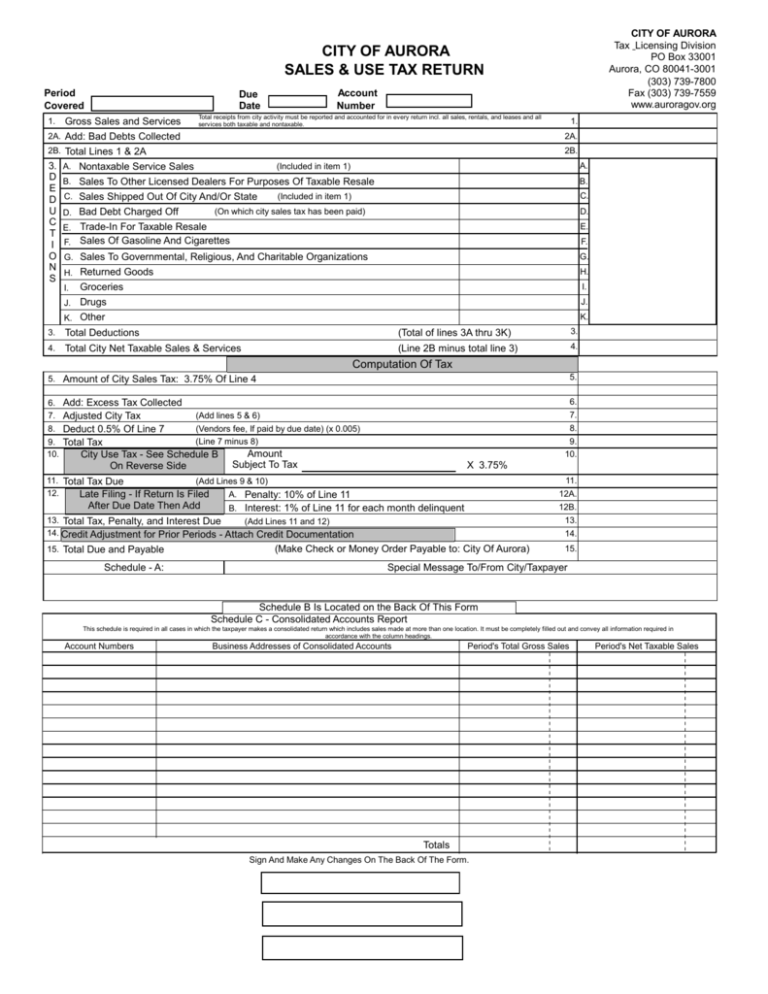

. This sales tax will be remitted as part of your regular city of Aurora sales and use tax. Do you need to submit a Tax Registration in Aurora CO. Government Sales Tax Sales Tax The City of Auroras tax rate is 8850 and is broken down as follows.

Aurora License Operating Agreement. Avalara License Guidance 99 Learn license requirements find applications and get help submitting them. Sale Tax License information registration support.

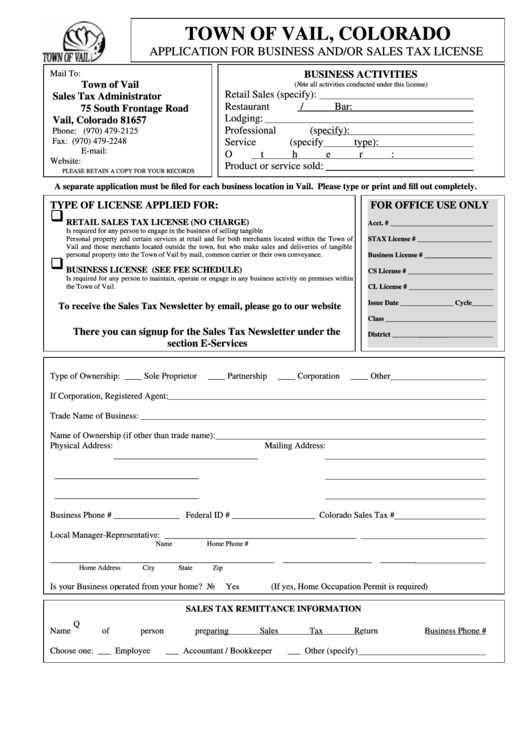

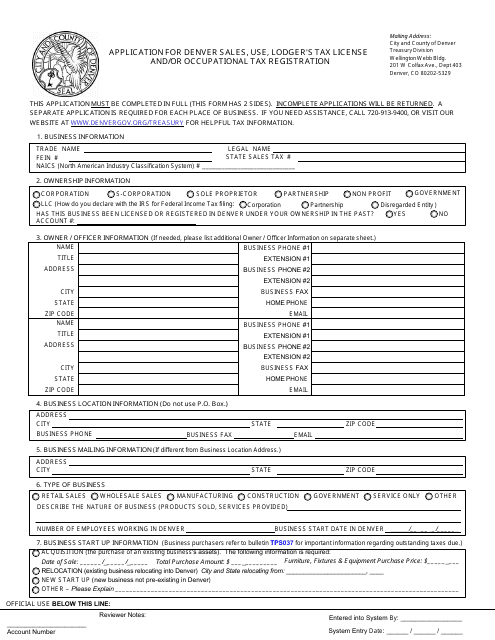

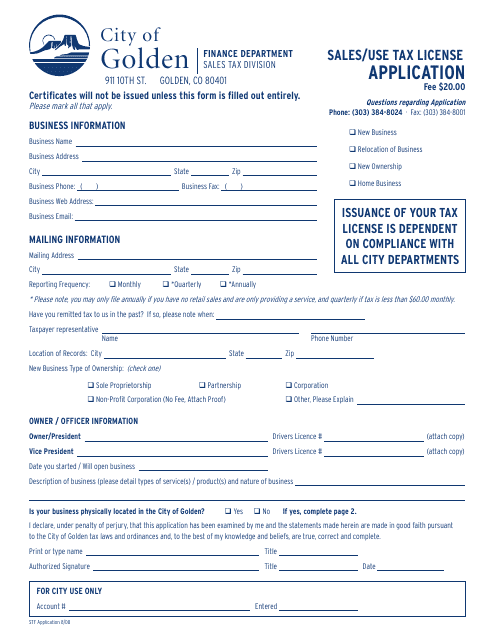

All Licenses need A n CO Occupation Business License Permit Business Permit 2. It also establishes the required sales use Occupational Privilege OPT andor Lodgers tax filing. Complete in Just 3 Steps.

After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. Ad New State Sales Tax Registration. Welcome to the official website of City of Aurora.

Ad Apply For Your Colorado Sales Tax License. All Licenses need A n CO Occupation Business License. Depending on the type of business where youre doing business and other specific.

This empowers you to. An Aurora Colorado Sales Tax Permit can only be obtained through an authorized government agency. Find out with a business license compliance package or upgrade for professional help.

Register my own Beauty Salon tax id in 80010 Aurora tax license in aurora coTax ID Registration Requirements for Beauty Salon in Aurora. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Administration of Education Programs 2 Administration of General Economic Programs 2.

Renewed licenses will be valid for a two-year period that. It is the responsibility of the Aurora business making a purchase from a company outside of Aurora to verify that the vendor is licensed to collect Aurora tax if in fact the company does. The minimum combined 2022 sales tax rate for Aurora Colorado is.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Visit Where can I get vaccinated or call 1-877-COVAXCO 1-877-268-2926 for vaccine information. The Colorado sales tax rate is currently.

From agricultural outpost to military bastion Aurora. The Colorado sales tax license in other parts of the country may be called a resellers license a vendors license or a resale certificate is for state and state-administered sales and use taxes. Avalara License Filing starting at 499 per location Let our business license.

Ad New State Sales Tax Registration. We Make the Process of Getting an Aurora Colorado Sales. The resulting business license is the companys authorization to conduct business in Aurora.

A retailer is required to obtain a sales tax license and collect sales tax on any retail sale of tangible personal property or taxable service made in Colorado if the retailer is doing business. This is the total of state county and city sales tax rates. There are a few ways to e-file sales tax returns.

The County sales tax. A sales tax license is required in order to collect and remit sales tax that is collected by the Colorado Department of Revenue. Understand the process of obtaining a business license in Aurora taxpayer rights and responsibilities taxes you may have to pay including Sales Tax Use Tax and Occupational.

If you dont form an License you can obtain A n CO. The minimum combined 2022 sales tax rate for Aurora Colorado is. Aurora is Colorados third largest city with a diverse population of more than 381000.

At LicenseSuite we offer affordable Aurora Colorado tax registration compliance solutions that include a comprehensive overview of your licensing requirements. City of Aurora 250 County 213 State 4225 Community GreetingsContact Info. Aurora CO Sales Tax Exemption Application In all likelihood the Sales Tax Exemption Application is not the only document you should review as you seek business license compliance in.

This empowers you to.

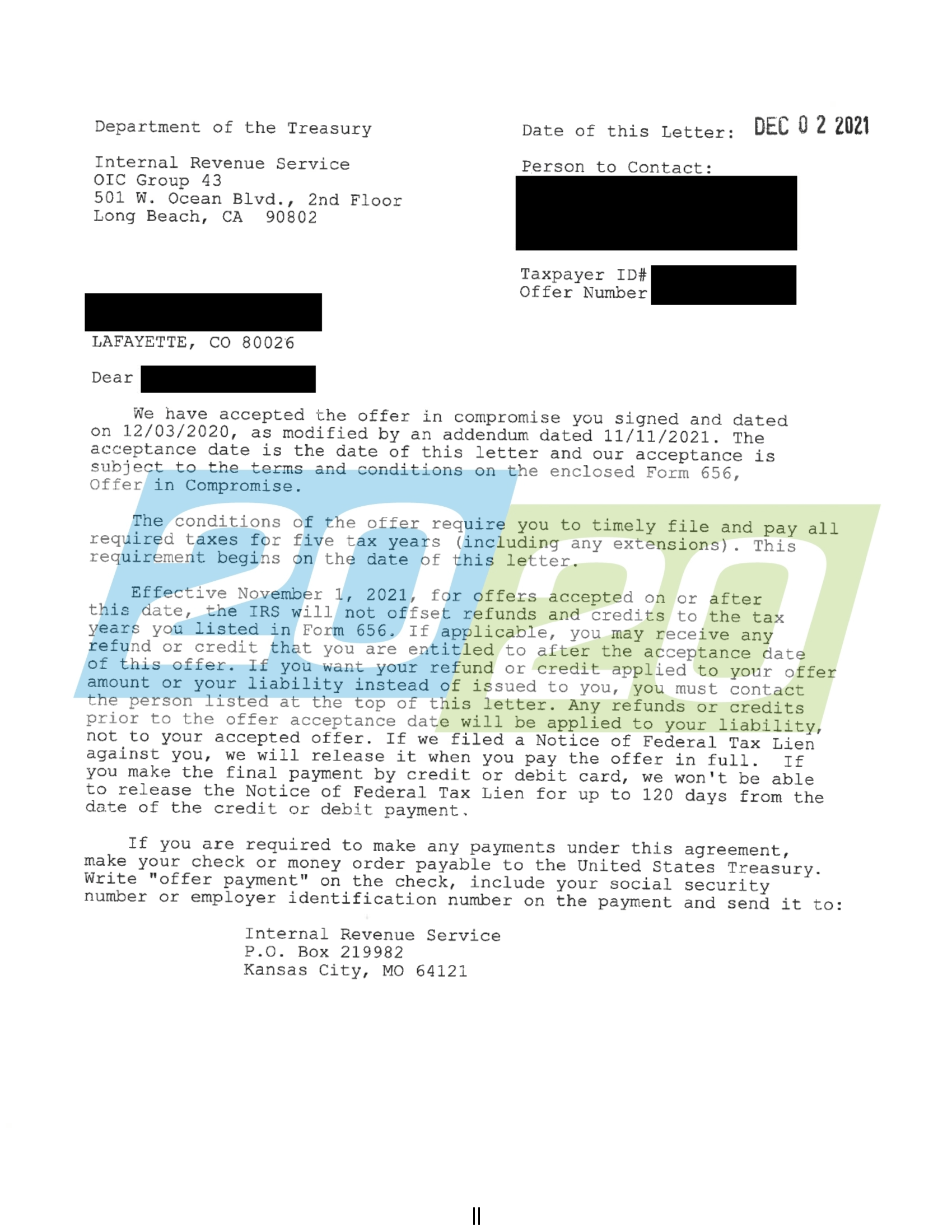

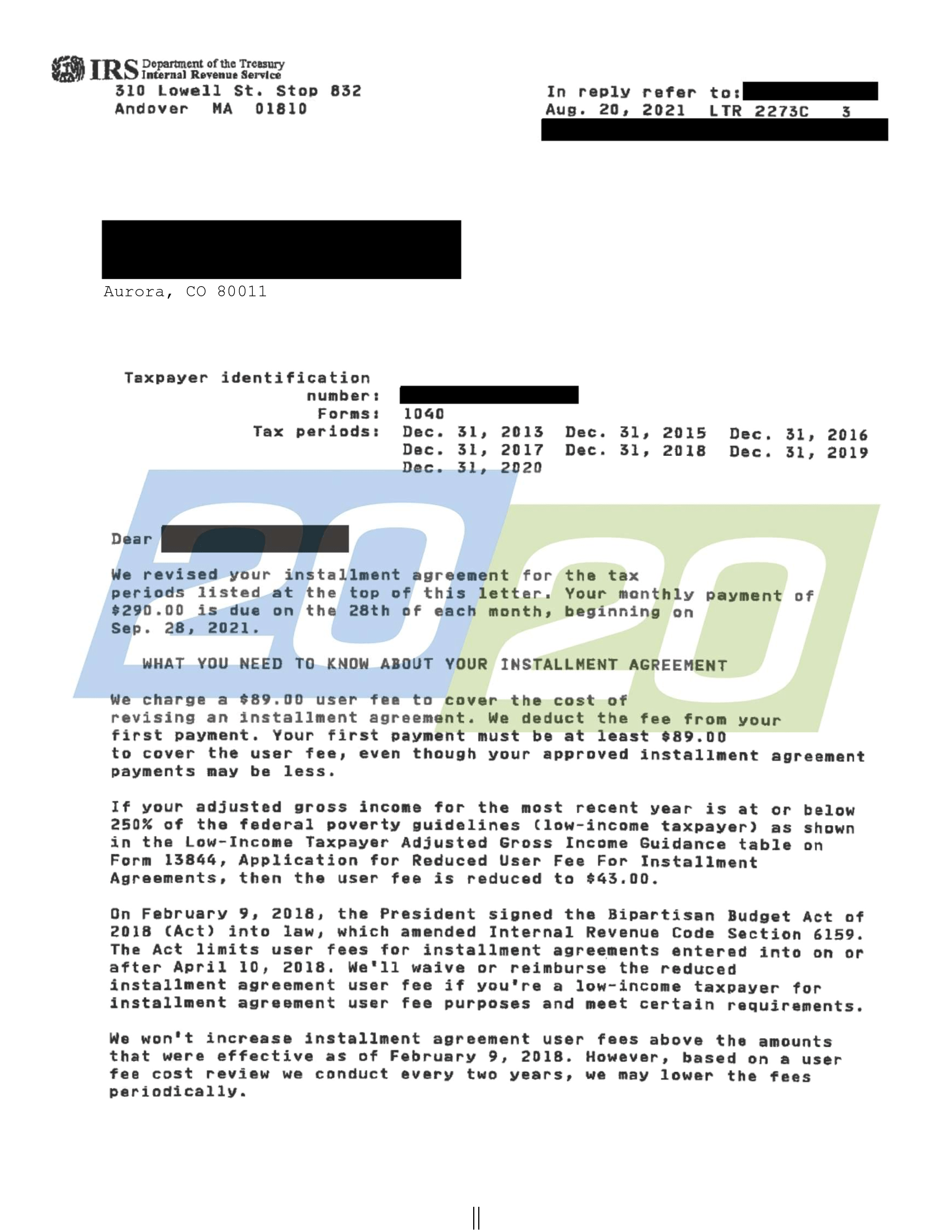

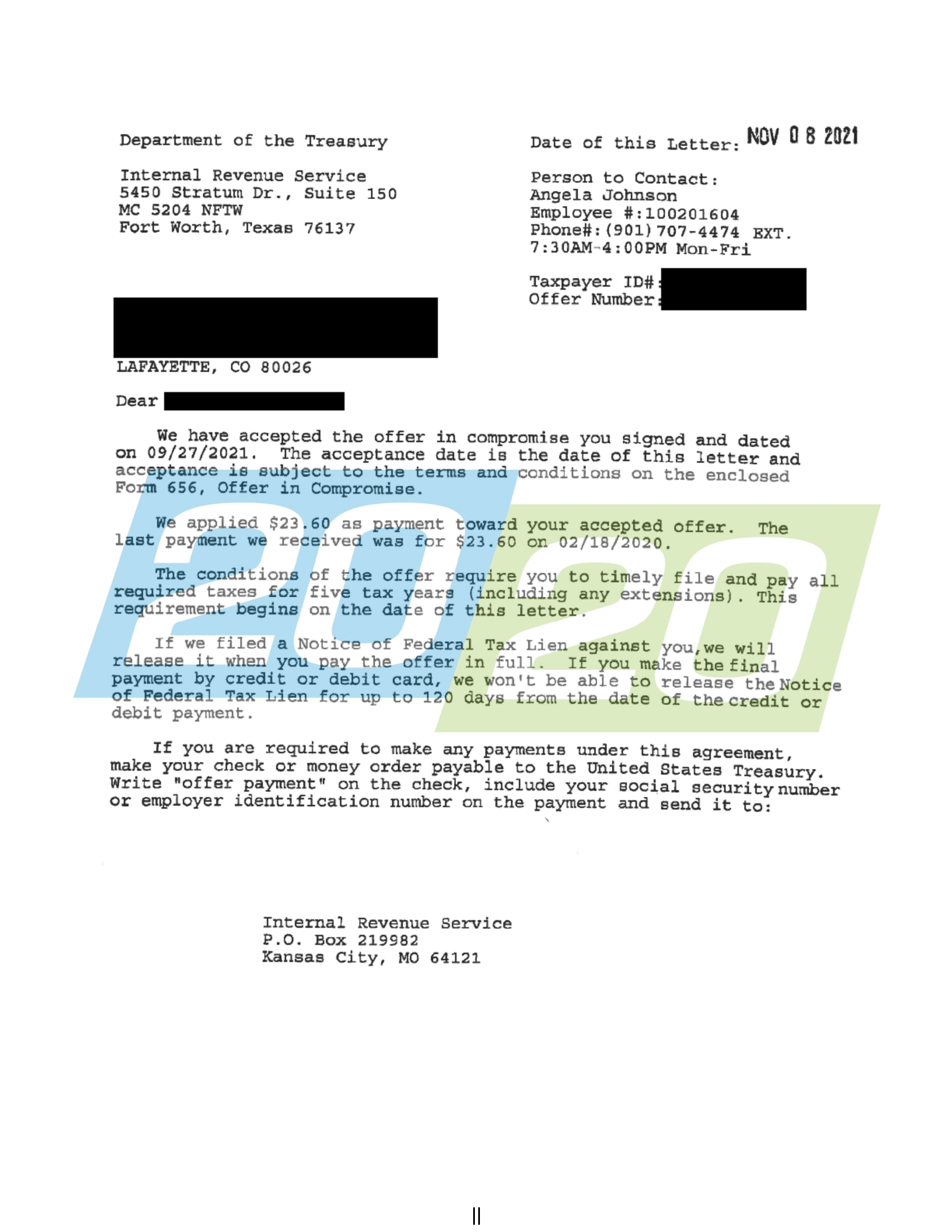

Tax Resolutions In Colorado 20 20 Tax Resolution

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Colorado Sales Tax Rates By City County 2022

How To Register For A Sales Tax Permit In Colorado Taxjar

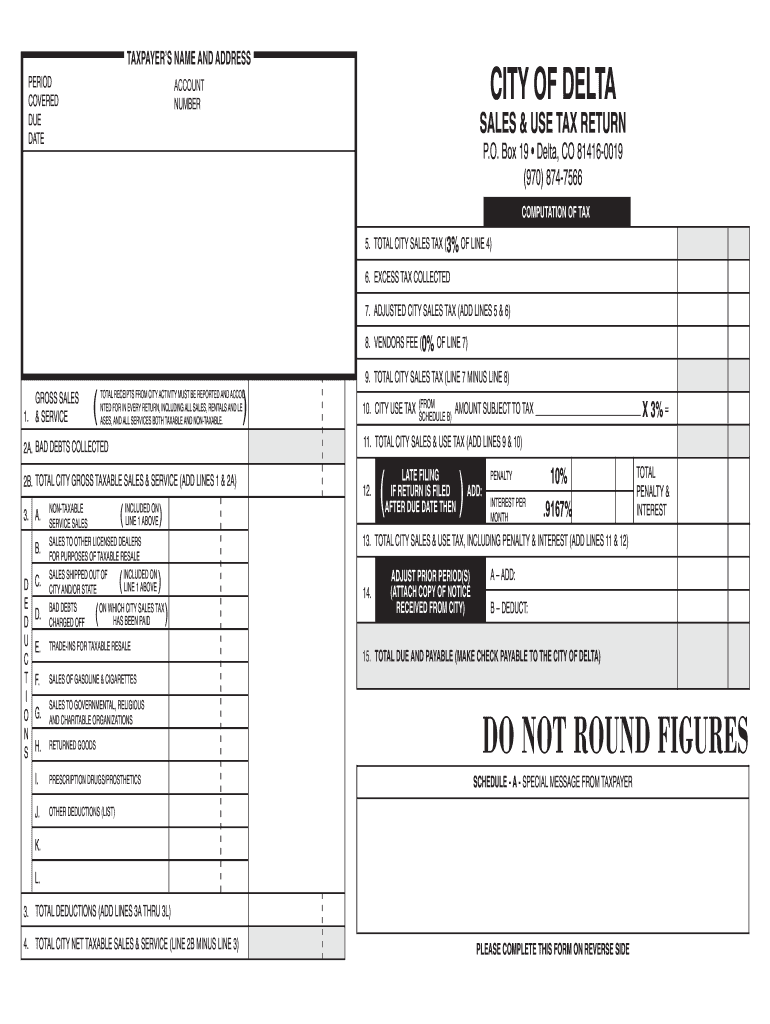

Co Sales Use Tax Return Fill Out Tax Template Online Us Legal Forms

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Tax Resolutions In Colorado 20 20 Tax Resolution

How To Look Up A Colorado Account Number Can Department Of Revenue Taxation

Tax Resolutions In Colorado 20 20 Tax Resolution